Stocks are due for a pullback.

The S&P 500 has effectively gone straight up for three months now, rising 30% from the April lows. As I write this today, numerous metrics are signaling that a consolidation, if not a pullback is overdue.

As Subu Trade (@subutrade) noted on X (formerly Twitter) yesterday, the S&P 500 has been above its 20-DMA for 52 days. This is one of the longest periods the S&P 500 has traded above that key moving average in nearly two decades.

The market is also overextended. The S&P 500 is currently ~4% above its 10-week moving average (the same as the 50-DMA). As the below chart illustrates, historically any time the S&P 500 gets this far above the 10-WMA, it’s marked a short-term peak.

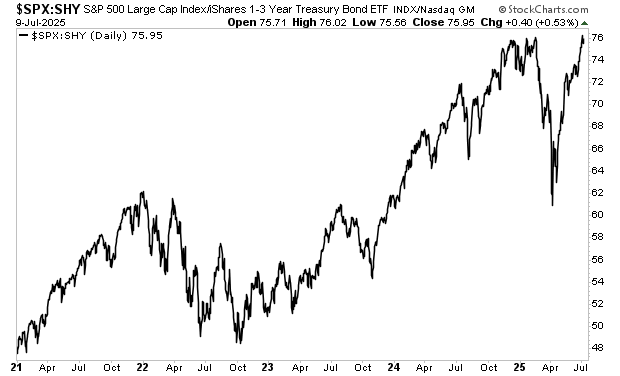

I would also note that the ratio between the S&P 500 and short-term Treasuries (SHY) is forming a double top, suggesting the markets are about to enter a period in which stocks underperform.

Put simply, now is NOT the time to be super aggressive putting new capital to work in the stock market. A major buying opportunity is coming... but not yet.

And I'll be guiding Macro King Premium subscribers to it.

We have a downside target for the coming correction at which point we'll be "backing up the truck" to buy stocks. And I have THREE targeted trades to profit from the next major bull market run when the smoke clears.

To join us in turning the markets into a source of life-changing profits, all you NEED to do is upgrade to Macro King Premium at the price of just $29.99 per month. Or for just $299.99 ( a 16% discount from the monthly rate)

To do so…

Macro King